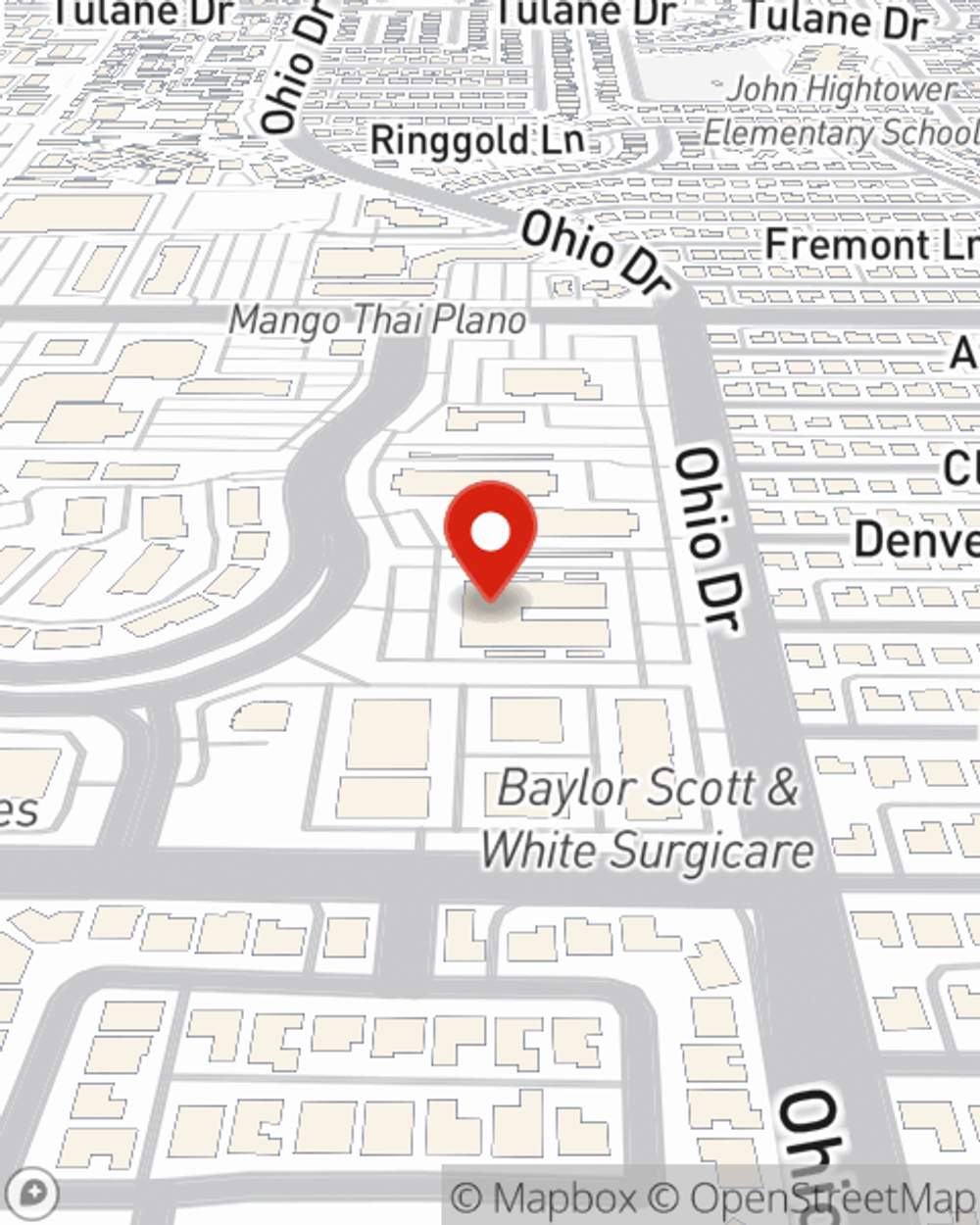

Business Insurance in and around Plano

One of Plano’s top choices for small business insurance.

Cover all the bases for your small business

Cost Effective Insurance For Your Business.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for your family. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, business continuity plans and worker's compensation for your employees.

One of Plano’s top choices for small business insurance.

Cover all the bases for your small business

Keep Your Business Secure

When you've put so much personal interest in a small business like yours, whether it's a beauty salon, an art gallery, or a tailoring service, having the right protection for you is important. As a business owner, as well, State Farm agent Kelly Cook understands and is happy to offer personalized insurance options to fit what you need.

Call or email agent Kelly Cook to talk through your small business coverage options today.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Kelly Cook

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.